According to ACCA Global, Financial reports comprise financial information. Therefore, it is essential to consider the kind of data that would likely be most helpful to current and potential investors, lenders, and other creditors in making choices about the reporting company drafting these reports. The qualitative accounting information mean the qualified data that provided by the business for the proper preparation of financial statements.

Investors see materiality in terms of the rate of change or change in the rate of change. What seems not to be material in business may turn out to be very important in the investment market. It has been established that the effect on earnings was the primary standard to evaluate materiality in a specific case. To say that information should be free from bias is not to say that standards setters or providers of information should not have a purpose in mind for financial reporting.

How GAAP Is Important for Business Organizations

Reliability is the primary quality that makes accounting information useful for decision-making. Reliable information is required to judge a firm’s earning potential and financial position. Some data items presented in an annual report could also be more reliable than others, which is an essential part of qualitative characteristics of accounting information.

- However, entity can present information in such a manner that it helps in understanding.

- In making decisions, the decision-maker will make comparisons among alternatives, which is facilitated by financial information.

- Conservatism in financial reporting should no longer connote deliberate, consistent, understatement of net assets and profits.

- For example, information regarding plant and machinery may be less reliable than certain information about current assets because of differences in uncertainty of realisation.

A change in one of these policies would require disclosure in the financial statements and notes to restore comparability between periods. This paper reviews fair value accounting method relative to historical cost accounting. Although both methods are widely used by entities in computing their income and financial positions, there is controversy over superiority.

Prepare Income and Expenditure Account of Youth Club from the …

Economic decision requires making choice among possible courses of actions. In making decisions, the decision-maker will make comparisons among alternatives, which is facilitated by financial information. Comparability implies to have like things reported in a similar fashion and unlike things reported differently. An implication is that accounting researchers and policy-makers should not be content with merely trying to improve the relevance of accounting disclosures.

Some reports need to be prepared quickly, say in case of takeover bid or strike. A neutral choice between accounting alternatives is free from bias towards a predetermined result. The objectives of (general purpose) financial reporting serve many different information users who have diverse interests, and no one predetermined result is likely to suit all users’ interests and purposes.

What are Qualitative Characteristics of Accounting Information?

Accounting to which all the possible expenses/losses are anticipated but all possible incomes/gains are not anticipated which are likely to happen in future to determine the profit or loss. The other qualities suggested by IASB are materiality, faithful representation, substance over form, neutrality, prudence, completeness, timeliness. Finally, it can be concluded that there are likely to be trade-offs between qualitative characteristics in many circumstances. Economic realism is not usually mentioned as a qualitative criterion in accounting literature, but it is important to investors.

Impact of prolonged carbapenem use-focused antimicrobial … – Nature.com

Impact of prolonged carbapenem use-focused antimicrobial ….

Posted: Mon, 04 Sep 2023 09:40:32 GMT [source]

The above mentioned characteristics (relevance, materiality, understandability, comparability, consistency, reliability, neutrality, timeliness, economic realism) make financial reporting information useful to users. These normative qualities of information are based largely upon the common needs of users. Predictive value and feedback value Since actions taken now can affect only future events,

information is obviously relevant when it possesses predictive value, or improves users’ abilities to

predict outcomes of events. Information that reveals the relative success of users in predicting

outcomes possesses feedback value. Feedback reports on past activities and can make a difference in decision making by (1) reducing uncertainty in a situation, (2) refuting or confirming prior

expectations, and (3) providing a basis for further predictions. Remember that although accounting information may possess

predictive value, it does not consist of predictions.

What are the qualitative characteristics of accounting information

The

reliability of information depends on its representational faithfulness, verifiability, and neutrality. There is a neighborhood for a convention like conservatism meaning prudence in financial accounting and reporting. Business and economic activities are surrounded by uncertainty, but they must be applied with care.

Consistent use of accounting principles from one accounting period to another enhances the utility of financial statements to users by facilitating analysis and understanding of comparative accounting data. And reliabilitythe extent to which information is verifiable, representationally faithful, and neutral.. No matter how reliable, if information is not relevant to the decision at hand, it is useless.

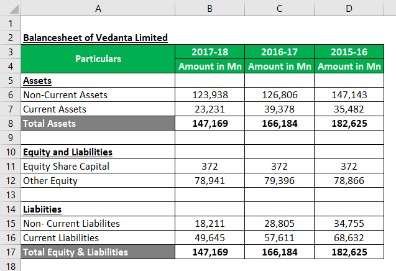

Historical cost accounting reports assets and liabilities at the initial price they were exchanged for at the time of the transaction. Conversely, fair value accounting quotes the prevailing price in the market. Nevertheless, while both methods of accounting affect financial statements, the impact of fair value accounting on the balance sheet and income statement is extreme due to the potential volatility of the method. Fair value accounting is deemed superior when compared to historical cost accounting because it reflects the current situation in the market whereas the later is based on the past.

ISSB releases first two sets of sustainability reporting standards – Wolters Kluwer

ISSB releases first two sets of sustainability reporting standards.

Posted: Wed, 12 Jul 2023 07:00:00 GMT [source]

David Bickerton is a member of WSO Editorial Board which helps ensure the accuracy of content across top articles on Wall Street Oasis. Previously a Portfolio Manager for MDH Investment how do you calculate net income attributable to non controlling interest Management, David has been with the firm for nearly a decade… This content was originally created by member WallStreetOasis.com and has evolved with the help of our mentors.

Reliability is described as one of the two primary qualities (relevance and reliability) that make accounting information useful for decision-making. Reliable information is required to form judgments about the earning potential and financial position of a business firm. There is a place for a convention, such as conservatism—meaning prudence, in financial accounting and reporting, because business and economic activities are surrounded by uncertainty, but it needs to be applied with care. Conservatism in financial reporting should no longer connote deliberate, consistent, understatement of net assets and profits.

- The presentation of financial information should be clear and concise for better understandability.

- A continuing source of misunderstanding about accounting information and measurements is the tendency to attribute to them a level of precision which is not practicable or attainable.

- Know the different types of accounting information systems and how they differ from one another.

- The materiality concept implies that not all financial information needs or should be communicated in accounting reports-only material information should be reported.

The attributes which influence the usefulness of the information by the users and distinguish between more practical and less helpful information are defined as Enhancing qualitative characteristics. Information provided should be free from bias and faithfully portray what it is meant to represent. According to Prabhjot Kaur, “Qualitative characteristics or qualities necessary for information serve a significant supporting role in the decision usefulness, decision model approach to accounting theory.”.

Generally accepted accounting principles

Timeliness matters for accounting information because it competes with other information. For example, if a company issues its financial statements a year after its accounting period, users of financial statements would find it difficult to determine how well the company is doing in the present. Reliability.Reliabilitythe extent to which information is verifiable, representationally faithful, and neutral. Is the extent to which information is verifiable, representationally faithful, and neutral.Verifiabilityimplies a consensus among different measurers. For example, the historical cost of a piece of land to be reported in the balance sheet of a company is usually highly verifiable.